michigan property tax rates by township

July 1 - June 30. Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 205369 385369 145369.

Why Are My Property Taxes Higher Than My Neighbor S Credit Com

Find All The Record Information You Need Here.

. Clarkston School District. Michigan is ranked number eighteen out of the fifty states in. Source data on millage rates is available here.

Summer Tax Rates. Median Annual Property Tax Payment Average Effective Property Tax Rate. Michigan case law has long drawn a distinction between ad valorem taxes and traditional special assessments.

Unsure Of The Value Of Your Property. Average 2016 true cash value of. For more details about the property tax.

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current. To claim a PRE the property owner must. 84 rows Minnesota.

Average 2016 taxable value of a residential parcel. BURT TOWNSHIP SCHOOL 282894. Median property tax is 214500.

For existing homeowners please enter the current taxable value of your property. 33020 Lansing of Total. This can be obtained from your assessment notice or by accessing your tax and assessing records on our.

In all areas of East Lansing and Meridian Township the taxable value of your property cannot exceed 50 of its market value. Total taxable value per capita is 67878 based on a population of 14528. 2018 Millage Rates - A.

2020 Millage Rates - A Complete List. TAXES ARE PAID IN ADVANCE. Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 205108 385108 145108 265108 205108 385108 Caledonia Twp 011020.

2019 Millage Rates - A Complete List. Ad Property Taxes Info. Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year.

They are split up into two bills. Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. Ada Township had a total taxable value of 986136828 in 2018 of which 81 is residential property.

These are 2017 millage rates retrieved from the State of Michigan. The second confusing part of Michigan property taxes is how they are collected. Send your check money order to.

The Property Tax Bill. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Simply enter the SEV for future owners or the Taxable Value.

2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. BURT TOWNSHIP SCHOO 274791454791 214791 334791 454791 Grand Island Twp 021030 MUNISING PUBLIC SCHOO 236756416756 176756 296756 416756. Rate is 186 mills for portion of township in River Valley schools 53538.

2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Cheshire Twp 031030 ALLEGAN PUBLIC SCHOOL 331401 511401 271401 391401 331401. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. This can be obtained from your assessment.

Individual Exemptions and Deferments. We are open Monday through Friday from 830 am to 430 pm. See for example Graham v City of Saginaw 317 Mich 427.

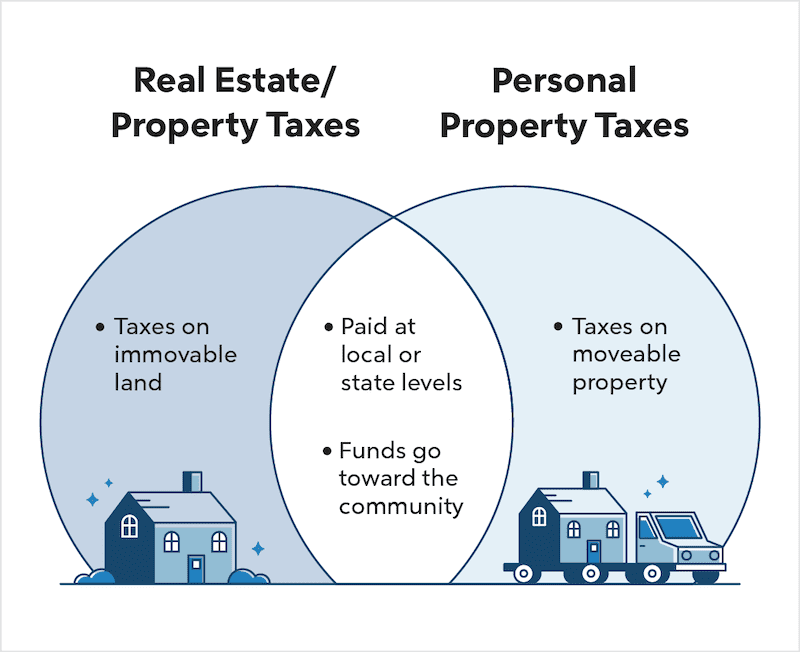

You can now access estimates on property taxes by local unit and school district using 2020 millage rates. The PRE is a separate program from the Homestead Property Tax Credit which is filed annually with your Michigan Individual Income Tax Return. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment.

That means if you purchased your home at. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. The winter tax bill that comes out on December 1st of each year.

This interactive table ranks Michigans counties by median property tax in dollars percentage of home value and. 2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY.

What Do Your Property Taxes Pay For

Did Your Property Tax Bill Send You Into Sticker Shock Open Source Richlandsource Com

A Michigan Man Underpaid His Property Taxes By 8 41 The County Seized His Property Sold It And Kept The Profits Reason Com Property Tax County Tax

Property Tax Appeal Tips To Reduce Your Property Tax Bill

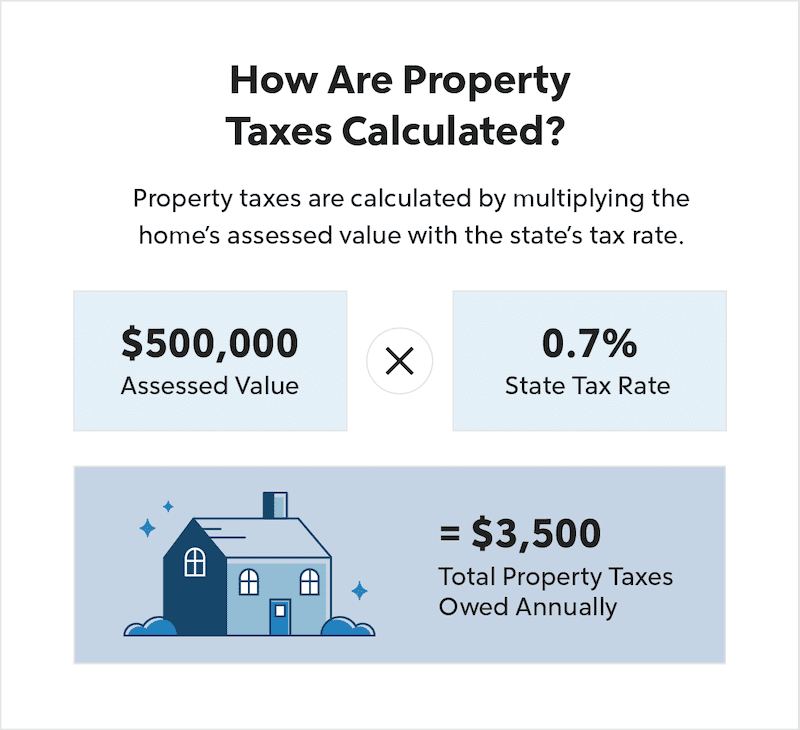

Property Tax How To Calculate Local Considerations

How To Calculate Michigan Property Taxes On Your Investment Properties

Property Taxes Hartland Township Michigan

Montgomery County Md Property Tax Calculator Smartasset

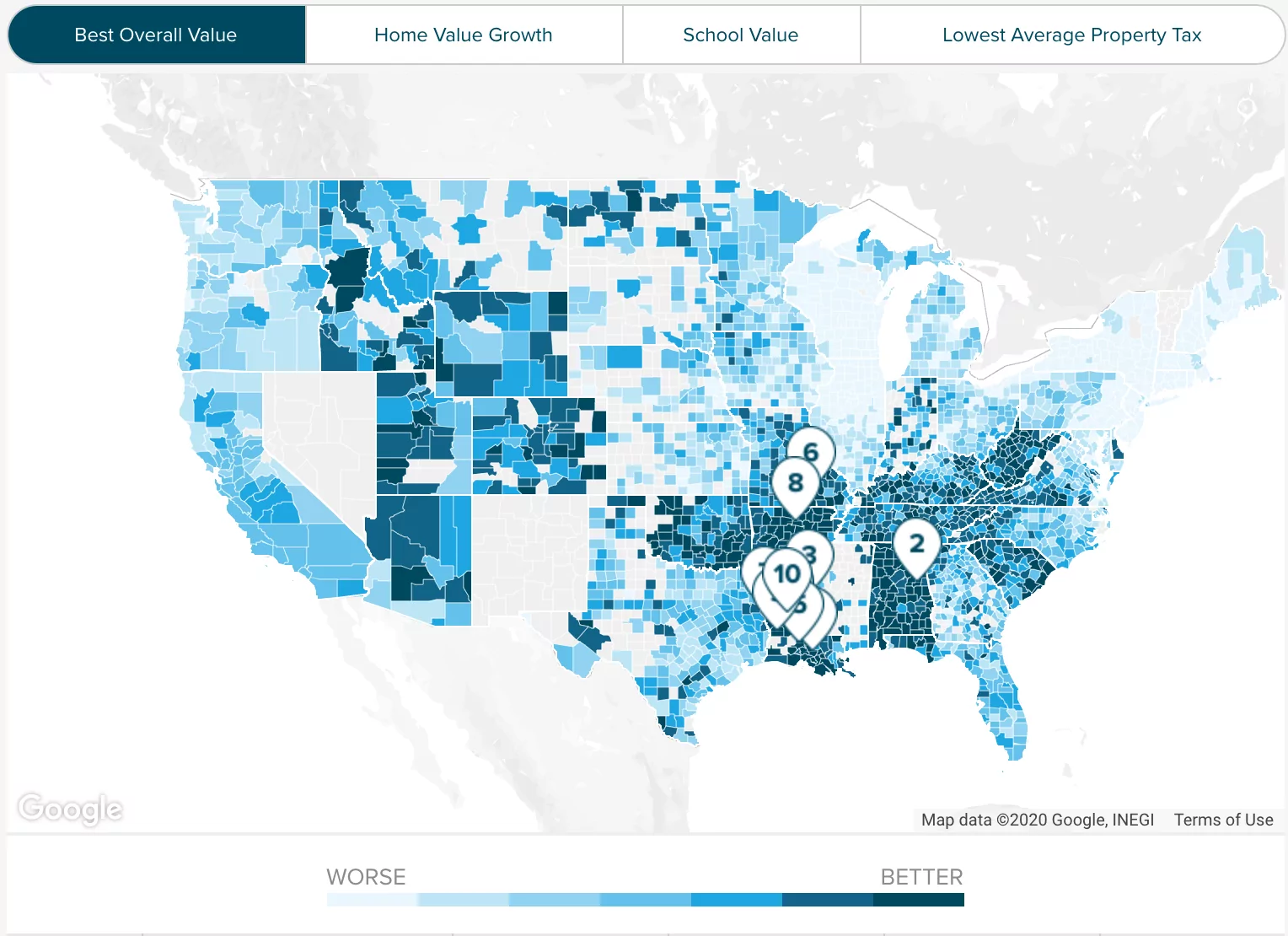

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

Real Estate Taxes Vs Property Taxes Quicken Loans

Real Estate Taxes Vs Property Taxes Quicken Loans

Winter Tax Bill Example Macomb Mi

Michigan Property Tax H R Block

How Property Taxes Are Determined In Michigan New Home Experts